Key Highlights

- Filing your first Canadian tax return ensures access to credits and benefits like GST/HST and the Canada Child Benefit.

- Canada’s tax system requires both federal and provincial tax filing through the Canada Revenue Agency (CRA).

- Key documents for filing include your Social Insurance Number (SIN), T4 slips, tuition receipts, and expense records.

- Newcomers can save with RRSP contributions or grow tax-free savings with a TFSA, depending on income levels.

If you’re new to Canada, filing your first tax return may feel overwhelming. The forms, the acronyms, and the deadlines can all seem intimidating, especially if you’ve never filed taxes in another country. But this is one of the most important steps you’ll take as a newcomer. It’s how you access key benefits, build financial credibility, and take advantage of deductions that can save you money.

Even if you didn’t work in your first year in Canada, it’s still a good idea to file. The Canada Revenue Agency (CRA) uses your tax return to determine your eligibility for credits like the GST/HST credit or the Canada Child Benefit. This guide walks you through everything you need to know to confidently file your first Canadian tax return.

Understanding the Canadian Tax System as a Newcomer

Canada operates a two-level tax system that may be different from what you’re used to in your home country. You’ll pay federal taxes to the Government of Canada and provincial or territorial taxes based on where you live as of December 31 of the tax year.

The Canada Revenue Agency (CRA) is the federal organization responsible for administering tax laws and collecting taxes. Think of them as Canada’s version of the IRS. They process your returns, send refunds, and manage benefit programs. Almost all of your tax-related interactions, such as filing returns or updating your address will go through the CRA.

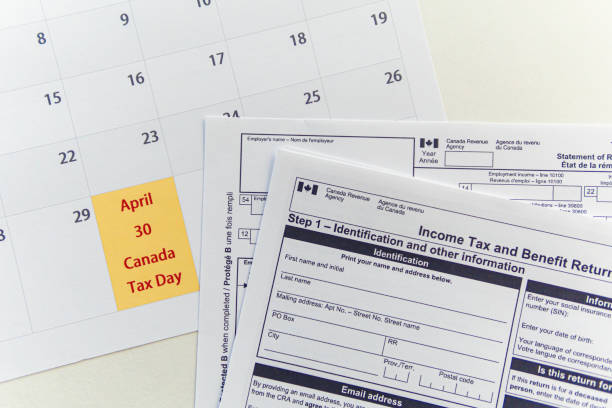

Tax Year and Deadlines

Canada’s tax year runs from January 1 to December 31. The filing deadline for individual taxpayers is April 30 of the following year. If you or your spouse are self-employed, the filing deadline is extended to June 15, though any balance owing must still be paid by April 30.

Tax season officially begins on February 24, when you can start filing your income tax and benefit return online. Even if you arrived in Canada partway through the year, you’ll report your worldwide income starting from the date you became a Canadian tax resident.

For tax purposes, the CRA considers you a resident if Canada is your home and you have significant ties, such as a house, a spouse, or dependents. This applies even if you only arrived mid-year.

Who Needs to File a Tax Return?

Residents for Tax Purposes

If you became a Canadian tax resident during the year, even if you arrived in December, you’ll generally need to file if you owe taxes or want to claim benefits. The CRA decides tax residency based on your ties to Canada, such as a home, a spouse, or dependents.

Working Newcomers

Anyone who earned employment income, self-employment income, or other Canadian-source income must file a return. Your employer will issue T4 slips that show your income and taxes already deducted. You’ll need these slips to file your return and possibly claim a refund.

Non-Working Newcomers

This is where many newcomers make costly mistakes. Even if you didn’t work, filing a return can qualify you for valuable benefits. The GST/HST credit provides quarterly payments to low- and modest-income households. If you have children, the Canada Child Benefit can offer significant monthly support. You can apply for these payments as soon as you arrive if you meet the eligibility criteria.

International Students and Temporary Workers

Students and temporary workers also often need to file, especially if they earned Canadian income or want to claim tuition credits for future years. Even if filing isn’t mandatory for you, doing so can still unlock benefits and help build your Canadian financial history.

Key Documents You’ll Need

Gathering the right documents before you start filing will save time and help ensure your return is accurate. Missing paperwork can delay processing and may cause you to miss out on valuable deductions or credits.

1. Essential Documents

Your Social Insurance Number (SIN) is absolutely crucial; you cannot file without it. If you haven’t applied for your SIN yet, make this your first priority as a newcomer.

T4 slips report your employment income and are issued by employers by the end of February. They show your total earnings, income tax deducted, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

T5 slips report investment income, such as interest from bank accounts or dividends.

2. Educational Documents

Students will need their T2202 tuition receipts from their educational institutions. These receipts allow you to claim tuition tax credits, which can be applied immediately or carried forward to future years when you have more income to offset.

3. Deduction-Related Documents

Keep receipts for rent (if your province offers rent credits), childcare expenses, medical expenses, and charitable donations. While medical expense deductions have minimum thresholds, they can still provide meaningful relief if you’ve had substantial healthcare costs.

4. Moving and Settlement Expenses

As a newcomer, you may be able to deduct eligible moving expenses related to immigrating to Canada. Hold on to receipts for transportation, temporary lodging, and other eligible costs tied to your move.

Quick Checklist for Newcomers

- Social Insurance Number (SIN)

- T4 slips (employment income)

- T5 slips (investment income, if any)

- T2202 tuition receipts (for students)

- Receipts for rent, childcare, medical expenses, and donations

- Receipts for moving and settlement costs

Having your records organized makes filing much smoother and ensures you won’t miss valuable deductions that could reduce your tax bill or increase your refund.

Common Tax Concepts for Newcomers

Understanding key Canadian tax concepts helps you make smarter financial decisions and maximize your benefits as a newcomer.

RRSP (Registered Retirement Savings Plan)

RRSPs are tax-deferred savings accounts where contributions reduce your taxable income for the year. As a newcomer, you earn RRSP contribution room equal to 18% of your previous year’s earned income, up to annual limits. Contributions can significantly reduce your taxes, making them valuable for higher-income earners.

However, don’t rush into RRSP contributions in your first year. If your income is low and you’re receiving benefits, the tax deduction might not provide immediate value. Consider your long-term income prospects before contributing.

TFSA (Tax-Free Savings Account)

TFSAs allow your savings to grow tax-free, and withdrawals aren’t taxed. You begin accumulating TFSA contribution room from the year you turn 18 and become a Canadian tax resident. For most newcomers, TFSAs offer more flexibility than RRSPs because withdrawals don’t affect your taxes or benefit eligibility.

Deductions vs. Credits

- Deductions reduce your taxable income (e.g., RRSP contributions).

- Credits directly reduce the tax you owe (e.g., tuition, GST/HST credit).

Common Credits for Newcomers

The GST/HST credit provides quarterly payments to offset sales taxes paid throughout the year. The Climate Action Incentive provides annual payments to residents of provinces with federal carbon pricing. The Canada Child Benefit provides monthly payments for families with children under 18, with amounts based on family income.

These benefits can total several thousand dollars annually for eligible families, making tax filing extremely valuable even for low-income newcomers.

Step-by-Step: How to File Your First Canadian Tax Return

Step 1: Gather Documents

Make sure you have your slips (T4s, T5s, T2202s), receipts, and SIN ready.

Step 2: Choose a Filing Method

- Online (NETFILE): The fastest way. Use certified software and submit directly to CRA.

- Paper filing: Still possible, but slower.

- Tax professional: Consider if your situation is complex (foreign income, self-employment).

For most newcomers, online software offers the best combination of convenience, accuracy, and cost-effectiveness.

Step 3: Choose Your Software

- Wealthsimple Tax: Free, simple interface, great for newcomers with straightforward returns.

- TurboTax: Paid option with step-by-step guidance and live support. Better for complex cases.

Check: NETFILE certified software

Step 4: Enter Income Details

Input all T4, T5, and other slips. If you had foreign income before moving, check CRA guidance on whether it must be reported.

Step 5: Apply Deductions and Credits

This is where software really helps newcomers. Quality tax software automatically identifies credits and deductions you’re eligible for based on your information. Don’t skip questions about tuition, moving expenses, or family situation—these could result in significant benefits.

Step 6: Submit Your Return

Review everything carefully before submitting. Once filed, keep copies of your return and all supporting documents for at least six years in case CRA requests them.

Most returns are processed within two weeks of electronic filing, and refunds are typically deposited directly into your bank account.

Common Mistakes Newcomers Make (and How to Avoid Them)

- Not filing at all because you didn’t work. Filing helps you access benefits.

- Forgetting to report worldwide income if considered a resident.

- Misunderstanding RRSP contribution room. You cannot contribute before filing your first return.

- Not updating your address or status with CRA, which can delay refunds and credits.

- Rushing the process, which often leads to mistakes that require amendments, delays refunds, and creates unnecessary paperwork.

Professional Help: When to Consider It

You may want professional tax help if:

- You have self-employment or multiple income sources.

- You own foreign property or income.

- You’re unsure about your residency status.

- You want to optimize deductions and credits for your first year.

Useful Resources for Newcomers

- CRA Newcomers to Canada

- Community Volunteer Income Tax Program (CVITP)

- Settlement.org – Taxes in Canada

Final Thoughts on Filing Your First Canadian Tax Return

Filing your first Canadian tax return is an important milestone. While the process may seem complicated, it is also an opportunity to start building your financial life in Canada. By filing on time and accurately, you not only meet a legal obligation but also unlock benefits and credits that can support you as you settle in.

Take the time to learn, keep good records, and consider software or professional help if you need it. Each year will feel easier, and your financial foundation will grow stronger.

FAQ

1. Do I have to file taxes if I just moved to Canada?

Yes, if you’re a resident for tax purposes. Even if you didn’t earn income, filing ensures access to benefits like GST/HST credits.

2. What if I didn’t earn any income this year?

You should still file. Filing allows you to claim benefits and start building RRSP contribution room.

3. Which tax software is best for newcomers?

Wealthsimple Tax is free and beginner-friendly, while TurboTax offers more support for complex returns.

4. What happens if I miss the deadline?

You may face penalties and interest on amounts owed. If you’re due a refund, you won’t be penalized, but it delays access to credits.

5. Can international students file taxes in Canada?

Yes, many are considered residents for tax purposes and may be eligible for tuition credits or GST/HST credits.