Imagine you’ve just landed a £35,000 job in London, but you’re also dreaming of buying a ₦20 million plot in Lekki, Lagos. How do you manage your day-to-day expenses in the UK while saving for your future back home?

As an African in the diaspora, you’re not just managing one financial life – you’re balancing two. You’re trying to build a stable life in your new country while also maintaining ties (and often financial responsibilities) back home.

In this guide, we’ll break down how to balance your immediate financial needs (like paying £1,000 monthly rent in Manchester) with your long-term goals (like saving KES 150M for a business startup in Nairobi).

Understanding Short-Term vs. Long-Term Financial Goals in the Diaspora Context

Let’s break down what we mean by short-term and long-term goals with some concrete examples:

Short-Term Financial Goals

These are your immediate needs and wants, typically within the next 1-3 years:

- Paying £800 monthly for a room in a shared flat in London

- Building a £5,000 emergency fund (about 3 months of basic expenses)

- Saving £2,000 for a trip home for your sister’s wedding next year

- Setting aside £300 monthly for remittances to family back home

Long-Term Financial Goals

These are your big aspirations, usually 5+ years down the line:

- Saving £40,000 to buy land in Lagos by 2030

- Building a retirement fund of £500,000 by age 65

- Accumulating $100,000 to start an agribusiness back home in 10 years

- Saving £60,000 for a down payment on a house in Birmingham by 2028

Now, let’s dive into how to balance these competing priorities.

5 Practical Strategies to Balance Your Short-Term and Long-Term Financial Goals

1. Prioritize with the “Naija Matrix”

Create a 2×2 matrix with “Importance” on one axis and “Urgency” on the other. Plot your goals:

- High Importance, High Urgency: Paying rent, sending money home for medical emergencies

- High Importance, Low Urgency: Saving for retirement, investing in property back home

- Low Importance, High Urgency: Buying tickets for an upcoming concert

- Low Importance, Low Urgency: Upgrading your wardrobe

Focus on the high-importance items first, balancing between urgent and non-urgent tasks.

2. Implement the “Diaspora Budget Rule”

Adapt the 50/30/20 rule to fit diaspora life:

- 50% for needs: £1,500 for rent, bills, groceries

- 15% for wants: £450 for entertainment, dining out

- 20% for short-term savings and remittances: £600 (£300 for your emergency fund, £300 to send home)

- 15% for long-term goals: £450 towards your land in Lagos or retirement fund

If your monthly take-home pay is £3,000, this is how you’d break it down.

3. Automate Your “Two-World” Savings Plan

Set up automatic transfers that happen as soon as you get paid:

- £300 to a “Home Support” account for regular remittances

- £300 to a high-yield savings account for your emergency fund

- £250 to a “Lagos Land” savings account

- £200 to your pension fund

This ensures you’re making progress on all fronts before you have a chance to spend the money.

4. Invest with a “Dual-Country” Strategy

Don’t put all your eggs in one basket – or one country:

- Invest £200 monthly in a UK stocks and shares ISA for tax-free growth

- Put about £100 monthly into Nigerian government bonds for higher yields

Explore Real Estate Investment Trusts (REITs) in both countries to gain property exposure without the hassle of direct ownership

5. Use Technology for “Trans-Continental” Money Management

Leverage apps and online platforms to manage money across borders:

- Use Wise or WorldRemit to send money home cheaply (saving up to 5% on transfer fees)

- Try the “52-Week Money Challenge” with the Piggyvest app, saving from £3 to £30 weekly

Practical Examples: Balancing Acts in Action

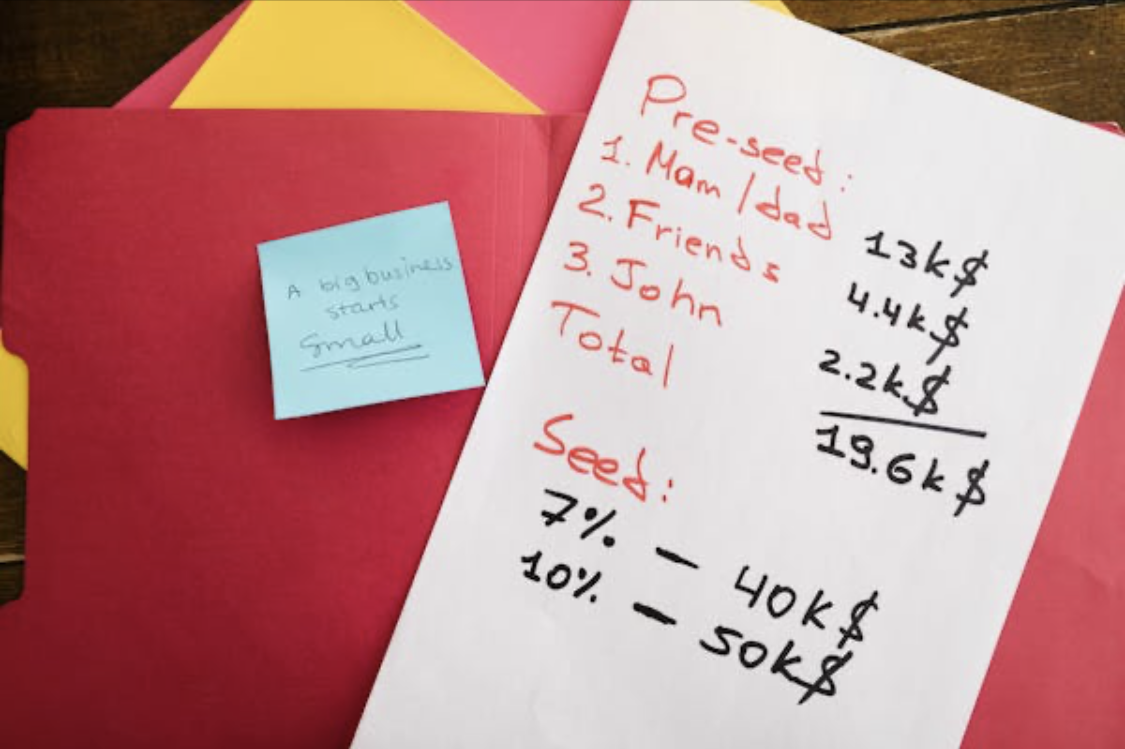

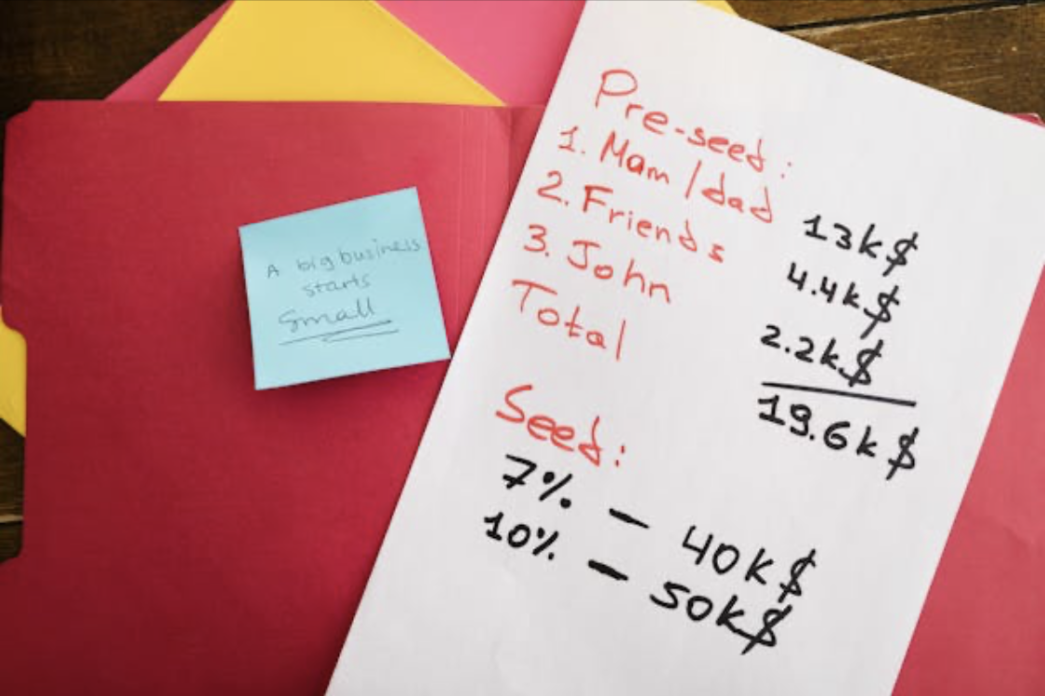

Scenario 1: The Young Professional

Meet Adebayo, 28, earning £40,000 in London, wanting to buy a ₦25 million flat in Lagos in 5 years.

Monthly plan:

- Needs (50%): £1,667

- Wants (15%): £500

- Short-term savings and remittances (20%): £667

- £400 for an emergency fund

- £267 for family support

- Long-term goals (15%): £500 for Lagos property fund

By following this plan, Adebayo can save £30,000 in 5 years. He plans to take a loan for the remaining amount.

Scenario 2: The Established Migrant

Meet Fatima, 40, earning €60,000 in Paris, supporting her family and saving for retirement.

Monthly plan:

- Needs (50%): €2,500

- Wants (15%): €750

- Short-term savings and remittances (20%): €1,000

- €600 for family support

- €400 for emergency fund

- Long-term goals (15%): €750

- €500 for retirement

- €250 for children’s education fund

This plan allows Fatima to support her family while also securing her future.

Conclusion: Mastering the Art of Financial Juggling

Balancing short-term and long-term financial goals as an African in the diaspora isn’t just about money – it’s about creating a bridge between your life abroad and your roots back home. It’s about being able to thrive in your new country while still contributing to and planning for a future in your homeland.

Remember, this balance will evolve. Maybe right now you’re sending 30% of your income home to support your family or build a house. That’s okay. As your situation changes, so too will your financial plan.

The key is to start where you are, use what you have, and do what you can. Even if you’re only putting £50 a month towards your long-term goals right now, that’s £600 a year you didn’t have before. It all adds up.

READ: Weekend Side Hustles: Turning Your Passions into Profits

Let’s dive into the world of weekend side hustles and discover how you can transform your cultural expertise and personal passions into a steady stream of extra income.